Mixed collateral refers to a situation in which different types of assets are used to secure a loan or a financial position. Instead of relying on a single type of asset, such as Bitcoin or Ethereum, users can combine various cryptocurrencies or tokens to meet collateral requirements.This approach offers several advantages. First, it can help reduce risk by diversifying the types of collateral, as the value of different assets may not fluctuate in tandem. For instance, if one asset declines significantly, others might remain stable or increase in value.Additionally, mixed collateral can make it easier for users to access liquidity. By allowing a variety of assets, platforms can accommodate a broader range of users and their financial needs. This flexibility could lead to better loan terms and a more efficient use of capital.Overall, mixed collateral enhances the lending process, making it more inclusive and adaptable to changing market conditions.

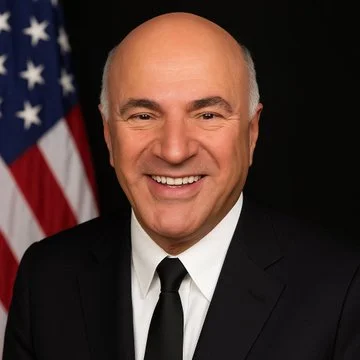

Kevin O’Leary Won $2.8 Million in Defamation Case Against Crypto Influencer Bitboy Crypto

Businessman and television personality Kevin O’Leary has secured a $2.83 million default judgment in a U.S. federal court against former