A vesting schedule outlines how and when tokens or coins are distributed to participants like founders, employees, or investors over a specified period. It is often used to ensure that stakeholders have a long-term commitment to the project’s success.Typically, a vesting schedule will specify a cliff period, during which no tokens are released. After this period, tokens are gradually unlocked on a regular basis, such as monthly or quarterly. This gradual release helps prevent price manipulation and ensures that participants remain aligned with the project’s goals.For example, if a project has a four-year vesting schedule with a one-year cliff, no tokens are distributed during the first year. After that, the tokens would be released gradually over the remaining three years.Vesting schedules are crucial for maintaining trust and stability within a project. They protect the interests of both the team and investors, ensuring that those who contribute to the project remain engaged and motivated to drive its success.

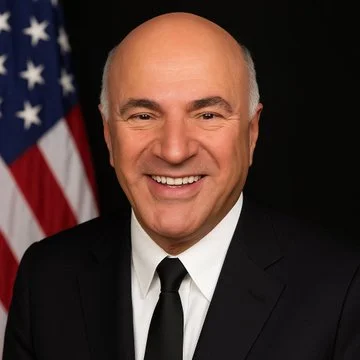

Kevin O’Leary Won $2.8 Million in Defamation Case Against Crypto Influencer Bitboy Crypto

Businessman and television personality Kevin O’Leary has secured a $2.83 million default judgment in a U.S. federal court against former