The global financial market hit an unexpected checkpoint this week after McDonald’s Corporation overtook Ethereum in total market capitalization, a moment that quickly caught the attention of both traditional investors and crypto analysts.

First highlighted by Crypto Rover on X, the comparison may look like a meme on the surface, but beneath it lies a clear signal about risk appetite, capital rotation, and how investors are positioning themselves in 2026.

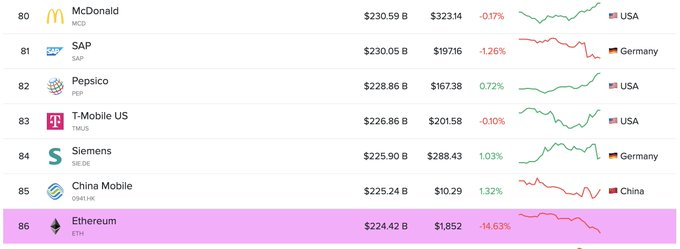

As of February 5, 2026, McDonald’s market value stands at roughly $242 billion, edging past Ethereum’s estimated $239 billion. The shift was driven by two opposing forces: steady strength in blue-chip equities and renewed pressure on crypto assets, particularly Ethereum, which has struggled to regain momentum after a volatile start to the year.

Burgers Versus Blockchain: Why This Happened

McDonald’s shares have climbed to record levels near $326, supported by consistent earnings, a defensive business model, and reliable dividends. In contrast, Ethereum has pulled back to around $1,960, reflecting weaker network activity, regulatory overhangs, and a broader “risk-off” mood across speculative assets.

While both assets are valued using the same market capitalization formula—price multiplied by circulating supply—the foundations of that value could not be more different.

McDonald’s is backed by predictable cash flow, franchise royalties, and an enormous global real estate footprint. Ethereum, on the other hand, derives its worth from network usage, transaction fees, and its role as the settlement layer for DeFi, NFTs, stablecoins, and Layer-2 ecosystems.

“Market capitalization reflects sentiment in the present, not destiny,” one analyst noted, pointing out that Ethereum remains the backbone of much of the on-chain economy despite its recent drawdown.

A Clear Risk-Off Signal

Ethereum’s decline comes after a sharp correction of nearly 40% over the past month, as liquidity tightened and speculative appetite faded. Meanwhile, McDonald’s has gained close to 13% year-on-year, benefiting from investors seeking stability in a high-interest-rate environment.

Dividends also matter. In periods where capital preservation takes priority, steady income often outweighs the promise of long-term innovation. McDonald’s quarterly payouts offer certainty; Ethereum’s value proposition depends on sustained developer activity and user demand, which tends to fluctuate more aggressively.

There is also the contrast between physical and digital assets. McDonald’s owns and controls vast tracts of prime real estate worldwide, giving its valuation a tangible anchor. Ethereum represents digital infrastructure—immensely powerful, but entirely dependent on continued adoption.

What This Means for Ethereum

This milestone does not suggest Ethereum is losing relevance. If anything, the fact that a decentralized blockchain platform can trade places with a global consumer giant highlights how far crypto has come. Just a few years ago, Ethereum rivaling major S&P 500 companies was seen as extraordinary. Today, the competition itself feels almost normal.

The more important indicators going forward are not price alone, but metrics such as Total Value Locked (TVL), transaction volumes, and Layer-2 growth. These data points will show whether Ethereum is being actively used or merely traded.

The Bigger Picture

McDonald’s briefly surpassing Ethereum is less about burgers beating blockchains and more about how capital behaves under uncertainty. Cash flow wins during cautious cycles; innovation regains favor when confidence returns.

For investors, this moment reinforces one lesson: modern portfolios are no longer split between old finance and new finance. They now exist side by side, with traditional corporations and crypto networks competing for the same capital—sometimes trading places along the way.

Related posts:

- WazirX Exchange Begins Recovery Efforts, Places Bounty on Hacker

- Circle IPO Looms As Valuation Hits $5B

- Hong Kong Set to Approve More Crypto Exchanges by Year-End

- Upbit Hack: South Korea Confirms North Korean Hackers Stole Crypto Assets

- BitMEX Fined $100 Million for Violating U.S. Money Laundering Laws