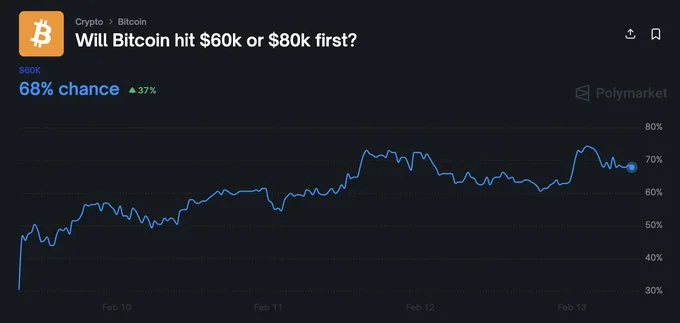

Polymarket traders are currently pricing in a 68% probability that Bitcoin will touch $60,000 before reclaiming $80,000, reflecting cautious short-term sentiment as the market digests recent volatility.

The odds, drawn from live positioning on Polymarket, show that participants expect further downside or at least a retest of lower levels before any sustained push higher. While prediction markets are not crystal balls, they offer a real-time window into trader conviction, especially during turbulent periods.

Polymarket has seen more than $83 million in cumulative trading volume across hundreds of active Bitcoin-related markets, underscoring how closely participants are watching price action. These markets update continuously as traders buy and sell shares tied to specific outcomes, meaning the 68% figure reflects capital at risk—not casual opinion polling.

Short-Term Pressure Dominates

Bitcoin recently slid sharply from the $70,000 region through the $60,000 range, eventually stabilizing near the $60K area after an aggressive selloff. That decline has left the broader market tone fragile.

Technically, analysts are focused on the $58,200 zone as a key support level. A decisive weekly close below that mark could expose the asset to deeper retracements, with $50,000 emerging as the next major psychological and structural support area.

In that context, Polymarket’s pricing suggests traders believe a downside probe is more likely than a swift breakout toward $80,000.

The current market structure supports that cautious outlook. Momentum indicators have cooled, and spot demand has yet to demonstrate the kind of strength typically associated with a strong reversal.

ETF Outflows Tell a Different Story

One of the more notable headwinds has been sustained capital outflows from U.S.-listed spot Bitcoin exchange-traded funds. Over a 10-day stretch, these products recorded approximately $1.19 billion in net outflows.

That steady withdrawal of institutional capital contrasts with the moderate optimism implied by a 68% probability of hitting $60K first—essentially a bet on near-term stabilization rather than collapse.

ETF flows often serve as a proxy for traditional investor appetite. Persistent outflows suggest institutions are reducing exposure, either locking in profits or managing risk amid macroeconomic uncertainty. Until those flows stabilize or reverse, upside momentum may remain limited.

New Short-Term Markets, Faster Reactions

Polymarket has also rolled out ultra-short-term markets tracking five-minute Bitcoin price movements. While these products increase engagement and liquidity on the platform, they may also amplify short-term volatility. Rapid-fire positioning can exaggerate minor price swings, particularly during low-liquidity periods.

Still, short-term speculation cannot override broader liquidity trends. Institutional flows, derivatives positioning, and macroeconomic factors—such as interest rate expectations and dollar strength—remain decisive drivers for sustained moves.

What the 68% Really Means

A 68% probability does not imply certainty. It simply indicates that traders are willing to risk capital on the view that Bitcoin will revisit $60,000 before mounting a rally to $80,000. In probabilistic terms, that leaves meaningful room for alternative outcomes.

For market participants, the key takeaway is not the headline number but the context behind it. Bitcoin is consolidating after a steep drawdown, institutional flows are negative, and technical support levels are being tested. Under those conditions, a cautious bias is understandable.

Whether $60K becomes a springboard or a trapdoor will likely depend on how buyers respond at support and whether institutional demand returns. For now, prediction market pricing suggests traders are preparing for another test of lower levels before any attempt at reclaiming $80,000.

No related posts.