Now, there are several ways to earn passive income with your crypto—but two of the most talked-about methods today are staking and yield farming. Both offer users the chance to grow their assets without constant trading, yet they work in very different ways. Understanding how each one functions can help you make smarter choices with your digital assets.

Choosing between staking and yield farming depends on how hands-on you want to be, how much risk you’re willing to take, and the kind of returns you’re targeting.

By the end of this guide, you’ll know exactly how staking vs yield farming compares, so you can decide which strategy aligns best with your crypto goals.

Key Takeaways

- Staking offers a more passive, lower-risk way to earn consistent rewards by locking up crypto assets to support blockchain networks.

- Yield farming involves lending or providing liquidity in DeFi protocols for potentially higher returns but comes with increased complexity and risk.

- Key differences between staking and yield farming include purpose, technical requirements, risk levels, reward types, and time commitment.

- Staking is ideal for long-term holders and passive income seekers looking for stable returns with minimal management.

- Yield farming suits active crypto users who are comfortable with DeFi tools and seeking to maximize returns through strategic asset deployment.

What is Staking?

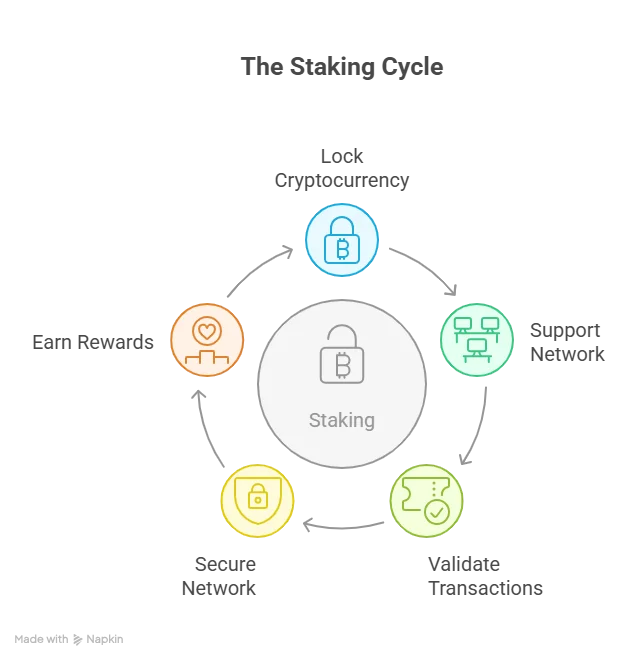

Staking is a process where you lock up your cryptocurrency in a blockchain network to help support its operations, such as validating transactions and securing the network, in exchange for earning rewards.

It’s primarily used in Proof-of-Stake (PoS) or Delegated Proof-of-Stake (DPoS) blockchains like Ethereum, Cardano, Solana, and Polkadot.

When you stake your coins, you’re essentially putting them to work. Instead of letting your crypto sit idle in a wallet, staking allows you to participate in the network while receiving periodic rewards, often in the same token you staked.

The reward rates can vary depending on the network, the amount staked, and how long you’re willing to lock your tokens. Some platforms offer flexible staking options, while others may require a fixed lock-up period. The process can be done directly through a blockchain wallet, a staking pool, or via exchanges like UEEx, Binance, Coinbase, or Kraken.

Staking is widely considered to be more straightforward than yield farming, with fewer technical steps involved and lower risk exposure, especially for those just starting to earn with crypto.

How Staking Works

Staking plays a crucial role in securing Proof-of-Stake (PoS) and related blockchain networks. Unlike Proof-of-Work (PoW) systems, which require energy-intensive mining, PoS relies on users locking up their tokens to validate transactions and maintain the network.

In return, these participants earn rewards, typically in the form of the network’s native cryptocurrency.

There are two main roles in staking:

- Validators: These are full participants in the network who validate transactions, propose new blocks, and ensure the integrity of the blockchain. To become a validator, one typically needs to stake a significant amount of tokens (e.g., 32 ETH to validate on Ethereum 2.0), run a node, and maintain a high uptime. In exchange, validators earn a portion of the transaction fees and newly minted tokens.

- Delegators (Investors): Not everyone has the technical setup or capital to become a validator. Most users participate as delegators by locking their tokens and assigning them to a validator. This way, they share in the rewards the validator earns, minus a small commission. Delegated staking lowers the barrier to entry and is ideal for users who want to earn without managing network infrastructure.

The staking process is relatively simple for most users:

- Choose a network that supports staking (e.g., Ethereum, Cardano, Solana).

- Select a staking method (direct staking, pooled staking, or via an exchange).

- Lock up your assets, either for a fixed term or flexibly.

- Receive regular staking rewards based on the amount staked and duration.

Now let’s break down how the two primary types of staking work:

Native Staking

Native staking refers to staking your tokens directly on the blockchain through its built-in staking mechanism. It’s the most straightforward form of staking and is supported by many blockchains like Ethereum (post-merge), Cardano, Polkadot, and Solana.

Here’s how it works:

- You “lock” or freeze your tokens in the network’s staking system.

- During this time, you cannot trade, sell, or move those assets.

- After the staking period ends, or in some cases, after an unbonding period, you get your tokens back along with the earned rewards.

The staking rewards vary depending on the network’s inflation rate, the total amount staked across the network, and your individual contribution. Think of native staking like a crypto equivalent of a fixed deposit account: you commit your coins for a certain period and receive yield in return.

Liquid Staking

Liquid staking was developed to solve the problem of illiquidity that comes with native staking. In native staking, once tokens are staked, they are locked for a fixed period, often several days or weeks. This limits the user’s flexibility in using their assets elsewhere in DeFi.

Liquid staking offers a workaround:

- You still lock your tokens to support the network, just like native staking.

- In return, you receive derivative tokens that represent your staked assets (e.g., stETH for Ethereum, bSOL for Solana).

- These derivative tokens can be traded, used as collateral, or deposited in DeFi protocols to earn additional yield.

For example, when you stake ETH through a platform like Lido, you receive stETH. This token mirrors the value of your staked ETH and continues to accrue staking rewards. You can then use stETH in lending platforms, liquidity pools, or even swap it for other tokens—something that’s impossible in native staking.

What Is Yield Farming?

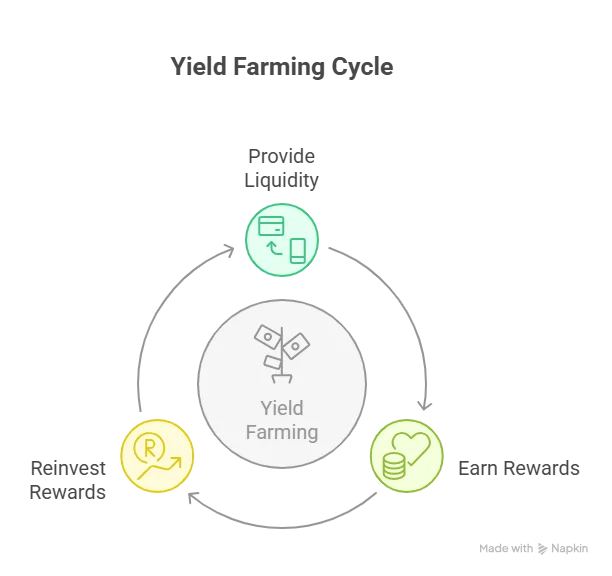

Yield farming is a decentralized finance (DeFi) strategy that allows crypto holders to earn rewards by lending or providing liquidity to DeFi protocols. In simple terms, it’s the process of using your crypto assets to generate more crypto by participating in decentralized platforms, usually by locking your tokens into liquidity pools.

These pools are smart contracts that facilitate trading, lending, or borrowing on platforms like Uniswap, Aave, Curve, PancakeSwap, and many others. In return for supplying assets to these pools, users earn yield, often in the form of additional tokens or interest.

How Yield Farming Works

Yield farming works by putting your crypto assets to use in decentralized finance (DeFi) protocols to earn passive income, usually in the form of interest, incentives, or governance tokens.

It relies on smart contracts to automate transactions and reward distributions without the need for centralized intermediaries.

Here’s a step-by-step breakdown of how it works:

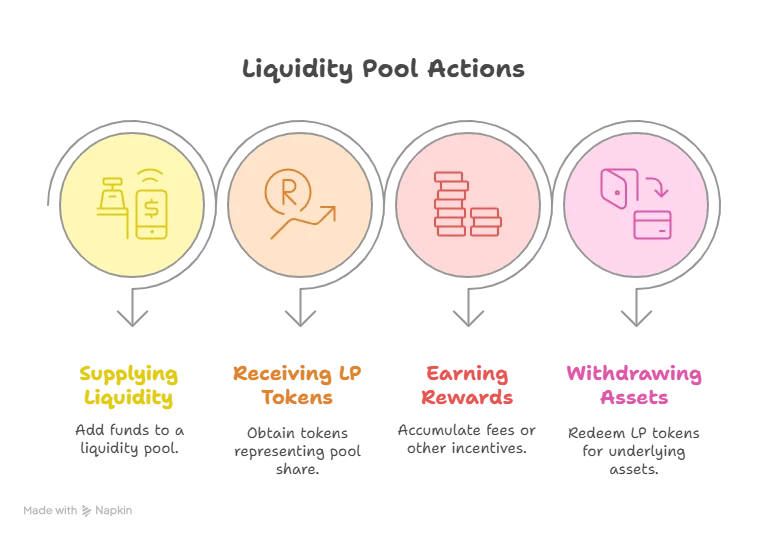

Supplying Liquidity to a Pool

To start yield farming, you deposit your crypto assets into a liquidity pool on a decentralized exchange (DEX) or lending platform like Uniswap, Curve, Aave, or Compound. These pools are smart contracts that manage the tokens users deposit.

In liquidity pools, you usually need to deposit a token pair, such as ETH and USDC in equal value. These funds enable other users to trade or borrow, while you, the liquidity provider (LP), earn fees or interest in return.

Receiving LP Tokens

After providing liquidity, you receive LP tokens (Liquidity Provider tokens) that represent your share in the pool. These tokens are crucial—they’re used to track your position and earnings in the pool.

LP tokens can often be staked on other platforms to earn even more rewards, a practice known as yield stacking or double farming.

Earning Rewards

The main sources of income in yield farming include:

- Trading Fees: Earned from transactions made by traders using the liquidity pool.

- Interest Payments: If you lend tokens instead of adding liquidity, you earn interest from borrowers.

- Incentive Tokens: Many platforms reward LPs with native governance tokens like UNI (Uniswap) or CAKE (PancakeSwap), which can be held, sold, or reinvested.

Some platforms offer very high Annual Percentage Yields (APYs), but these are often tied to newly launched or volatile tokens.

Withdrawing Your Assets

When you’re ready to exit, you return your LP tokens to the platform, which unlocks your original deposit plus any earned interest or fees. Keep in mind that the value of your deposited assets may have changed due to impermanent loss, a common risk in yield farming.

Some users go further and use advanced yield farming by:

- Swapping rewards for more stable assets

- Reinvesting rewards into other pools

- Using leveraged yield farming strategies to amplify gains (and risks)

These advanced tactics often require more technical knowledge and an active management approach.

Key Differences Between Staking and Yield Farming

While both staking and yield farming offer ways to earn passive income from crypto, they differ significantly in structure, purpose, risk, and effort.

Here’s a detailed comparison across 14 key areas:

| Factor | Staking | Yield Farming |

| Purpose | Network security and transaction validation | Yield generation through lending or liquidity provision |

| How It Works | Lock tokens in a PoS network or pool to validate transactions | Deposit tokens into DeFi protocols or liquidity pools |

| Potential Returns (APY) | Moderate, predictable (e.g., 5%–15%) | Higher but variable (e.g., 20%–300%+) depends on pool and token performance |

| Complexity Level | Low – often available via centralized exchanges or wallets | High – requires DeFi interaction, LP tokens, and pool strategy |

| Deposit Periods | Fixed or flexible, often with lock-up or cooldown periods | Typically flexible, can enter/exit pools at any time |

| Transaction Fees | Low – usually one-time fee to stake or unstake | High – multiple smart contract interactions; gas fees (especially on Ethereum) |

| User Involvement | Passive – “set and forget” approach | Active – requires monitoring, rebalancing, claiming rewards |

| Reward Types | Native staking rewards (e.g., ADA, ETH, UECoin) | Governance/native tokens, fees, and incentives (e.g., UNI, CAKE) |

| Capital Requirements | May have minimums (e.g., validator roles); low with exchanges/pools | No fixed minimum, but high capital often needed for meaningful returns |

| Technical Knowledge Needed | Low – wallet setup or centralized exchange staking | High – knowledge of DEXs, LPs, impermanent loss, smart contracts |

| Investment Risks | Slashing, validator downtime, protocol risks | Smart contract bugs, rug pulls, high volatility, impermanent loss |

| Loss Type | Slashing (partial token loss for validator errors) | Impermanent loss (value loss due to price divergence in liquidity pools) |

| Time Commitment | Minimal – long-term reward accumulation | Significant – frequent management, migration, yield tracking |

| Suitable Assets | PoS-native tokens (ETH, ADA, DOT, UECoin) | Token pairs, stablecoins, DeFi assets (e.g., USDT/BNB, ETH/DAI) |

Purpose

The primary purpose of staking is to support the security and operation of a blockchain network, especially those using Proof-of-Stake (PoS). Your tokens help validate transactions and secure the chain.

In contrast, yield farming focuses on generating returns by providing liquidity or lending assets within DeFi protocols. The goal is to maximize profits through strategic allocation.

How They Work

Staking involves locking coins in a blockchain protocol, either directly or via a staking pool. You earn rewards by helping validate transactions.

Yield farming uses smart contracts to lend or provide liquidity to DEXs or DeFi apps. You earn interest, fees, or incentive tokens based on the value and duration of your contribution.

Potential Returns

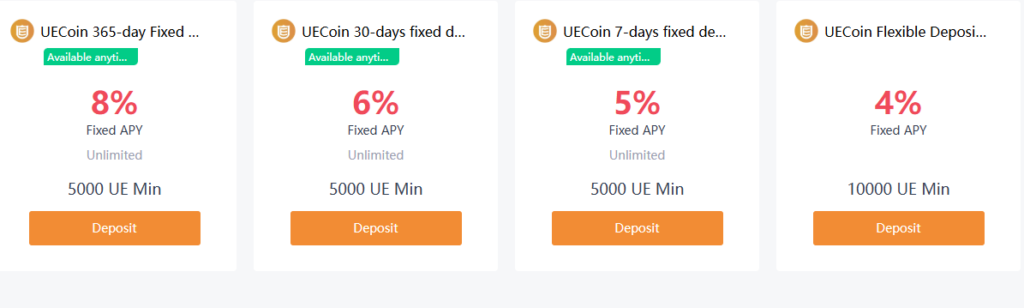

Staking offers stable and predictable APYs, often ranging from 5% to 15%, depending on the network.

Yield farming can produce higher but highly variable returns, with APYs ranging from 20% to 300% or more, especially in early-stage or volatile DeFi projects.

For example, on UEEx, you can stake UECoin with a 365-day fixed term at an 8% APY, with a minimum deposit of 5,000 UE.

Complexity Levels

Staking is generally simpler and more beginner-friendly. Most platforms offer one-click staking through wallets or exchanges.

Yield farming often involves more technical steps, such as pairing tokens, interacting with DEXs, managing LP tokens, and manually claiming or reinvesting rewards.

Deposit Periods

Staking usually comes with fixed or flexible lock-up periods. Some protocols allow unstaking anytime, while others have bonding or cooldown durations.

Yield farming offers greater flexibility, letting users enter and exit liquidity pools at any time—although some farms may require lock-in periods to earn bonus rewards.

Transaction Fees

Yield farming on networks like Ethereum can incur high gas fees due to multiple smart contract interactions.

Staking fees are typically lower, involving just one or two transactions. Some platforms, like UEEx, Binance, etc., absorb or simplify these fees through centralized staking services.

Read Also: Ethereum vs Ethereum Classic

User Involvement

Staking is mostly hands-off after the initial setup. You stake, wait, and receive rewards.

Yield farming often needs active management—monitoring returns, claiming tokens, moving funds across pools, or reacting to market changes.

Reward Types

Stakers receive staking rewards, usually paid in the same native token (e.g., ETH, ADA, UECoin).

Yield farmers often earn governance or native DeFi tokens (like CAKE or UNI), plus a share of trading fees or interest, making it more reward-diverse.

Capital Requirements

Staking may require a minimum amount, especially for direct validator roles. Exchanges or pools usually reduce this barrier.

Yield farming doesn’t have fixed minimums, but optimal results often require higher capital to offset gas fees and achieve significant returns.

Technical Knowledge Needed

To stake, users typically need a wallet and access to a staking pool or exchange. It’s beginner-accessible.

Yield farming requires a good understanding of DEXs, smart contracts, impermanent loss, and token standards. It’s best suited for users comfortable navigating DeFi tools.

Investment Risks

Staking risks include slashing (penalties for validator misconduct), network failure, or long unbonding periods.

Yield farming risks are mostly DeFi-related—such as smart contract vulnerabilities, rug pulls, and token price crashes.

Impermanent Loss and Slashing

Stakers face the risk of slashing if validators behave maliciously or go offline.

Yield farmers are exposed to impermanent loss—when the value of deposited tokens changes relative to each other, potentially reducing your withdrawal amount despite high APY.

Time Commitment

Staking is low-maintenance—you can stake once and let it run.

Yield farming requires frequent monitoring—APYs change often, and new farms can offer better incentives. This makes it more time-intensive and strategy-driven.

Suitable Assets

You can stake PoS-compatible tokens like ETH (via Ethereum 2.0), ADA, DOT, and UECoin.

Yield farming typically supports stablecoins, wrapped tokens, or token pairs used in liquidity pools—like USDT/ETH or BNB/CAKE.

Similarities Between Yield Farming and Staking

Despite their structural and operational differences, staking and yield farming share several important similarities.

Both strategies are designed to help crypto holders generate passive income from their assets without having to sell them. Here’s a breakdown of their core similarities:

Passive Income Generation

Both staking and yield farming are methods of earning income passively. Users commit their crypto assets to a blockchain protocol or DeFi platform and receive periodic rewards in return.

These rewards are typically expressed as Annual Percentage Yields (APYs) and are distributed regularly—either daily, weekly, or monthly—depending on the platform.

Asset Locking for Rewards

Both involve locking or committing crypto tokens for a certain duration. In staking, the tokens are locked to support a Proof-of-Stake network, while in yield farming, tokens are deposited into liquidity pools or lending protocols. In both cases, you relinquish full control over your assets temporarily in exchange for earning rewards.

Crypto Token Requirements

Whether you’re staking or yield farming, you’ll need compatible crypto tokens. Staking requires native tokens of PoS blockchains (like ETH, ADA, or UECoin), while yield farming typically requires DeFi-supported tokens or token pairs (like USDT/BNB or ETH/DAI). The choice of token significantly impacts your return.

Risk of Token Price Volatility

In both strategies, your overall profit is affected by market volatility. Even if the APY is high, a drop in the value of the token can reduce your real returns. If you’re earning 10% APY in a token that drops 30% in value, you’re still at a net loss. This makes market awareness essential for both staking and farming.

Accessible Through DeFi and CeFi Platforms

Both methods are now available across centralized (CeFi) platforms like UEEx, Binance, or Coinbase, and decentralized (DeFi) platforms like Uniswap, Curve, or Lido. Users can choose where to participate based on their preferred balance between control, ease of use, and yield potential.

No Need to Sell Assets

Both staking and yield farming enable you to earn rewards without selling your crypto. This is beneficial for long-term holders who want to maintain exposure to an asset while still generating returns. It also helps avoid taxable events in some jurisdictions, as you’re not realizing capital gains.

Can Be Combined in Strategies

In some cases, staking and farming can complement each other. For example, in liquid staking, users stake tokens (like ETH) and receive derivative tokens (e.g., stETH) that can be used for yield farming on other platforms. This dual-earning mechanism is popular among advanced users seeking to maximize returns.

Advantages and Disadvantages of Staking

Staking is one of the most popular ways to earn passive income in crypto, especially for those holding Proof-of-Stake (PoS) assets. Like any investment strategy, staking has its strengths and limitations.

Here’s a look at the advantages and disadvantages of staking to help you decide if it aligns with your crypto goals:

Advantages of Staking

Passive Income with Low Effort

Staking allows crypto holders to earn regular rewards simply by locking up their tokens. Once staked, the process is mostly automatic—no need for constant monitoring or complex interactions.

Supports Network Security and Stability

By staking your tokens, you contribute to the blockchain’s security, governance, and transaction validation. This helps decentralize the network and ensures smooth protocol operation.

Lower Technical Barrier

Compared to yield farming, staking is simpler and more beginner-friendly. Many wallets and exchanges offer one-click staking, making it accessible even to those with limited technical knowledge.

Predictable and Stable Returns

Staking typically offers fixed or algorithmically adjusted APYs, which makes earnings more predictable than yield farming. This appeals to users seeking consistent returns without extreme volatility.

No Need for Complex Token Pairing

Staking usually requires just one token, unlike liquidity farming, which may need token pairs. This simplifies the investment process and reduces exposure to impermanent loss.

Disadvantages of Staking

Lock-Up Periods and Reduced Liquidity

Staked tokens are often locked for a period or require an unbonding time before withdrawal. This reduces your ability to respond quickly to market changes or emergencies.

Risk of Slashing

Some PoS blockchains penalize validators for malicious or negligent behavior through a process called slashing, which can result in partial loss of staked funds. Delegators may share in that penalty.

Exposure to Market Volatility

Even if the APY is attractive, token price fluctuations can reduce your actual earnings. If the value of the staked asset drops sharply, your overall profit may turn into a loss.

Centralized Platform Risks

Staking through centralized platforms or exchanges may come with custodial risk—you rely on the platform’s security and honesty. If they experience a hack or collapse, your funds could be lost.

Limited Token Choice

Not all tokens are eligible for staking. Only certain proof-of-stake coins support it, so your portfolio must include compatible assets like ADA, DOT, or UECoin to participate.

Advantages and Disadvantages of Yield Farming

Below is a detailed breakdown of the advantages and disadvantages of yield farming to help you determine if it fits your strategy.

Advantages of Yield Farming

High Earning Potential

Yield farming often delivers significantly higher APYs than staking, especially during the early phases of a protocol or liquidity pool. Some pools offer returns above 100% APY, although they are usually short-lived and come with risks.

Multiple Reward Streams

Farmers can earn rewards from several sources simultaneously—trading fees, platform incentives, and governance tokens. For example, by providing liquidity to a DEX, you may receive trading fees plus bonus tokens like UNI or CAKE.

Capital Efficiency

Many DeFi strategies allow users to reuse assets. For example, in some platforms, you can deposit collateral, earn interest, and simultaneously farm with the interest-bearing tokens—maximizing yield from a single capital base.

Flexibility and Accessibility

Unlike staking, yield farming generally does not require long lock-up periods. Users can enter and exit liquidity pools at will, giving them more flexibility in managing funds and adjusting to market conditions.

Boosted DeFi Participation

Yield farming encourages users to interact with decentralized protocols, which supports liquidity, enhances decentralized exchange (DEX) activity, and contributes to the overall growth of DeFi ecosystems.

Disadvantages of Yield Farming

High Complexity

Yield farming is technically demanding. It often requires interacting with smart contracts, managing multiple tokens, understanding LP mechanics, and navigating risks like impermanent loss.

Impermanent Loss

When you provide token pairs to liquidity pools, you’re exposed to impermanent loss—a reduction in your total value compared to just holding the tokens. This occurs when the prices of the tokens diverge significantly.

Smart Contract Risks

DeFi platforms operate via smart contracts that can contain bugs or vulnerabilities. If exploited, funds locked in yield farming pools may be lost permanently. Unlike centralized services, there’s no recourse in such cases.

Gas and Transaction Fees

On networks like Ethereum, high gas fees can quickly eat into profits, especially for smaller deposits or frequent farming actions like compounding, withdrawing, or switching pools.

Short-Term Sustainability

Many high-yield farming opportunities are unsustainable in the long run. Rewards can drop sharply when incentive programs end or when too many users flood into a pool.

Market Volatility

Token rewards earned through farming may be highly volatile. A reward token might offer high APY today but crash in value tomorrow, undermining overall returns.

Constant Monitoring Required

Yield farming is time-intensive. It often requires tracking multiple metrics like APYs, reward emissions, token prices, and pool health. Inactive users may miss out on optimal returns or expose themselves to risk.

Who is Staking Suitable For?

Staking is a crypto-earning method that suits individuals who prefer stability, predictability, and low-maintenance investing.

Here’s a closer look at who staking is best suited for:

Long-Term Crypto Holders

If you plan to hold PoS tokens like ETH, ADA, or UECoin for an extended period, staking is ideal. Instead of keeping your coins idle, staking allows you to earn consistent rewards on them while you wait for price appreciation.

For example, on UEEx, long-term holders can stake UECoin for a fixed 365-day term with an 8% APY and a 5,000 UE minimum. This suits investors who prefer stability over flexibility.

Passive Income Seekers

Staking is designed for those who want to earn without active participation. Once your tokens are staked—either directly on-chain or via an exchange—you receive regular rewards without needing to manage liquidity, monitor price pools, or rebalance portfolios.

Low-Risk Investors

Compared to yield farming, staking is less complex and generally lower risk, making it suitable for conservative investors. While it still involves some risks—like slashing or token price volatility—it avoids the high risks associated with impermanent loss or smart contract exploits found in DeFi farming.

Users with Limited DeFi Experience

Staking is perfect for crypto users who may not be comfortable with decentralized exchanges (DEXs), liquidity pools, or smart contracts. Most centralized exchanges and wallets offer one-click staking features, reducing the technical barrier to entry.

People Who Prefer Predictable Returns

If you’re looking for fixed or stable APYs, staking delivers a more predictable earning experience than yield farming, where rewards can fluctuate daily. This makes staking a reliable strategy for income planning and portfolio diversification.

Who is Yield Farming Suitable For?

Yield farming is best suited for crypto users who are actively engaged in DeFi, comfortable with higher risk, and looking for maximum return potential on their crypto assets.

Here’s a breakdown of the ideal yield farming participant:

Experienced Crypto Users and DeFi Enthusiasts

Yield farming involves interacting with smart contracts, liquidity pools, and decentralized exchanges (DEXs). It suits those who already understand how DeFi works and are comfortable navigating platforms like Uniswap, PancakeSwap, or Curve.

If you’ve used DEXs, added liquidity, or participated in token swaps, you’re in a good position to farm yield effectively.

High-Risk, High-Reward Investors

Yield farming appeals to those with a higher risk appetite who are willing to manage market swings and smart contract risks for the chance of superior APY returns. Some pools offer triple-digit APYs, especially during the early stages of launch or during high-incentive periods.

Active Portfolio Managers

Because yield farming often requires daily or weekly monitoring, it’s ideal for users who are actively managing their crypto portfolios. This includes shifting funds between pools, compounding rewards, or adjusting positions to maximize returns.

If you enjoy optimizing strategies and tracking performance metrics, yield farming can be highly rewarding.

Users with Capital Flexibility

Yield farming typically works better with a larger portfolio or diversified capital, as high gas fees—especially on Ethereum—can eat into profits. Those with access to sidechains or L2s (like Arbitrum, BNB Chain, or Polygon) also gain more cost-efficiency.

Tech-Savvy and Strategic Users

The yield farming process includes managing liquidity pool tokens (LP tokens), calculating impermanent loss, and understanding reward mechanisms. If you’re confident with smart contract tools, browser wallets like MetaMask, and managing risks on-chain, farming can be a powerful strategy.

Which Is Better: Staking or Yield Farming?

Choosing between staking and yield farming depends entirely on your financial goals, risk tolerance, and crypto experience level. Both methods offer ways to earn passive income on your assets, but they differ significantly in complexity, returns, and associated risks.

Let’s break it down clearly to help you decide which is better for you.

For Simplicity and Stability: Staking Wins

If your priority is simplicity, predictable returns, and low technical barriers, staking is the better option. It’s easy to get started, especially through exchanges that offer one-click staking, and it doesn’t require constant monitoring or complex strategy.

For Higher Earning Potential: Yield Farming Leads

Yield farming has the edge in potential returns, particularly in newer DeFi projects or incentivized pools. If you’re experienced in DeFi, comfortable with smart contracts, and can manage risks actively, farming can generate much higher APYs than staking.

However, with higher returns comes greater volatility and technical demand—impermanent loss, smart contract bugs, and token price swings are all factors to consider.

For Passive Income: Staking Is More Hands-Off

If you’re looking for a “set-and-forget” method, staking is more aligned with that goal. Once your assets are locked in a staking pool or platform, rewards are generated with little to no intervention.

Yield farming, on the other hand, often requires constant monitoring, adjusting positions, and moving funds between pools to maintain high yield.

For Diversification: Combine Both

Many savvy investors actually use both strategies to balance risk and return. For example, staking stable or core holdings like ETH, ADA, or UECoin for predictable income, while allocating a smaller portion of assets to yield farming for growth opportunities.

Final Thoughts

Don’t get it twisted, staking and yield farming serve different goals, but both offer real opportunities to grow your crypto. Staking is ideal for passive, steady income with fewer risks.

Yield farming brings higher potential rewards, but demands more involvement and risk tolerance. The better option depends on your strategy, capital, and technical comfort. Explore both to diversify your earnings. As crypto adoption grows, understanding these earning methods puts you one step closer to making smarter financial decisions in DeFi.

Frequently Asked Questions

Is Yield Farming the Same as Staking?

No, yield farming and staking are not the same—staking secures blockchain networks for rewards, while yield farming involves lending or providing liquidity in DeFi protocols to earn variable returns.

What Is the Main Benefit of Yield Farming Compared To Simple Staking?

The main benefit of yield farming compared to simple staking is the potential for significantly higher returns through active participation in DeFi protocols.

Is Yield Farming Still Profitable?

Yes, yield farming can still be profitable, especially on high-incentive DeFi platforms, but returns vary based on market conditions, pool selection, and associated risks like impermanent loss and smart contract vulnerabilities.

Is Staking More Profitable Than Mining?

Staking can be more profitable than mining for many users due to lower operational costs, but profitability depends on factors like coin type, hardware costs (for mining), staking APY, and market conditions.

What Is the Difference Between Staking and Earn?

Staking involves locking crypto to support a blockchain network and earn rewards, while “Earn” typically refers to lending or saving crypto on platforms to receive interest, without directly securing a network.