New legislation and agency initiatives could accelerate mainstream adoption — experts share what this means for investors, exchanges, and the global market.

A Turning Point for U.S. Crypto Policy

For years, the U.S. crypto industry operated in a gray area, hampered by a lack of clear rules and jurisdictional conflicts between agencies. This environment often stifled innovation and deterred institutional capital.

However, the current wave of policy-making is a direct response to the industry’s growth and an acknowledgment that digital assets are an enduring part of the financial system.

Recent developments, including new laws for stablecoins, progress on anti-Central Bank Digital Currency (CBDC) bills, amongst others, are promising clearer rules, are collectively reducing uncertainty, and fostering a pro-growth environment for digital assets.

Context & Background

For years, U.S. cryptocurrency regulation has been characterized by tight scrutiny and ambiguous guidelines, creating challenges for innovation and adoption.

The early 2010s saw the rise of initial coin offerings (ICOs), which the Securities and Exchange Commission (SEC) began treating as securities under existing laws, leading to landmark enforcement actions like the 2017 DAO Report and subsequent lawsuits against projects such as Telegram in 2020.

Under former SEC Chair Gary Gensler (2021–2025), the agency pursued a “regulation by enforcement” approach, filing over 100 actions against crypto firms, including high-profile cases against Coinbase and Binance for operating unregistered exchanges. This era was marked by jurisdictional overlaps between the SEC, Commodity Futures Trading Commission (CFTC), and other agencies, resulting in uncertainty that drove many companies offshore and deterred institutional investment.

The 2022 crypto market crash, exemplified by the FTX collapse, further intensified calls for clearer rules, prompting President Biden’s 2022 Executive Order on digital assets, which aimed to balance innovation with risk mitigation but fell short of comprehensive legislation.

These new measures represent a stark departure, shifting toward a more permissive, proactive, and adoption-oriented framework under the Trump administration and new SEC Chair Paul S. Atkins, who assumed office in April 2025. Unlike the prior enforcement-heavy stance, initiatives like the GENIUS Act for stablecoins, the Anti-CBDC Surveillance State Act (passed by the House in July 2025), and the August 2025 Executive Order exploring crypto in 401(k) plans emphasize clear rules, consumer protections, and private-sector innovation over government control.

This approach aligns with Atkins’ vision for “bright-line rules” through Project Crypto, announced in July 2025, which seeks to classify digital assets more predictably and encourage U.S.-based growth. The SEC’s earlier approvals of spot Bitcoin and Ether ETFs in 2024 set the stage, making crypto accessible via traditional finance channels and signaling regulatory maturation.

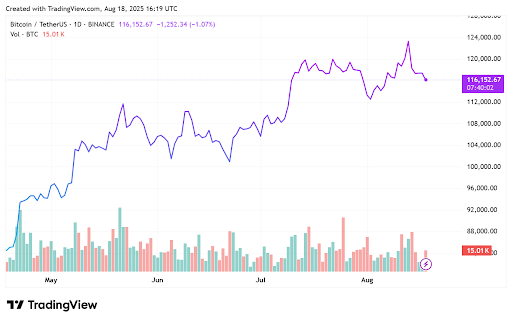

Recent bullish market indicators underscore the positive impact of these policy shifts. Bitcoin reached an all-time high of $124,496 in August 2025 before settling around $115,000–$124,474 amid minor corrections, reflecting sustained investor confidence driven by ETF inflows and pro-crypto legislation.

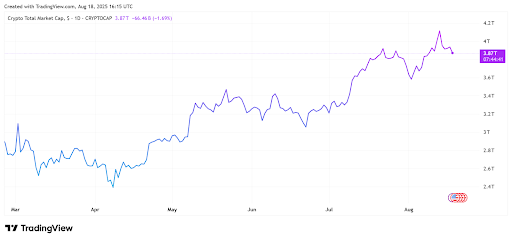

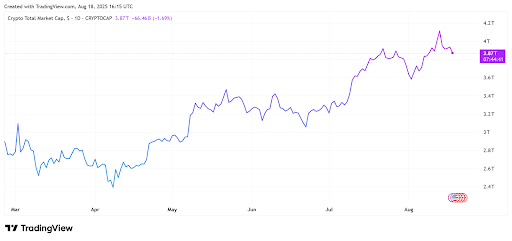

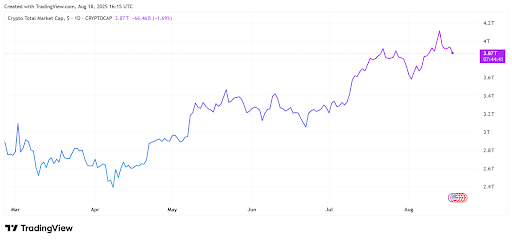

The total crypto market capitalization hovered near $4 trillion earlier in the month, buoyed by institutional adoption following ETF approvals, which have attracted billions in investments.

Analysts attribute these gains to reduced regulatory uncertainty, with projections for Bitcoin potentially hitting $124,175 by month’s end, highlighting the market’s resilience and optimism tied to U.S. policy evolution.

Analysts attribute these gains to reduced regulatory uncertainty, with projections for Bitcoin potentially hitting $124,175 by month’s end, highlighting the market’s resilience and optimism tied to U.S. policy evolution.

Analysts attribute these gains to reduced regulatory uncertainty, with projections for Bitcoin potentially hitting $124,175 by month’s end, highlighting the market’s resilience and optimism tied to U.S. policy evolution.

The GENIUS Act: A Framework for Stablecoins

Signed into law on July 18, 2025, the “Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act” marks the first comprehensive federal legislation for stablecoins in the U.S.

The act establishes a clear regulatory framework, mandating that stablecoin issuers back their tokens on a 1:1 basis with cash or U.S. Treasury securities. It also requires issuers to register with a federal authority, release public disclosures, and submit to regular reserve audits. To enhance consumer protection, the law grants stablecoin holders priority over other creditors in the event of an issuer’s bankruptcy.

These provisions are designed to bolster financial stability and ensure that tokens pegged to the U.S. dollar can be reliably redeemed.

Anti-CBDC Legislation Gains Traction

Reflecting growing concerns over financial privacy and government overreach, the U.S. House of Representatives passed the “Anti-CBDC Surveillance State Act” in July 2025. The bill, which now moves to the Senate for consideration, aims to prohibit the Federal Reserve from issuing a CBDC directly to consumers.

Proponents of the legislation argue that a government-controlled digital currency could become a tool for monitoring citizens’ financial transactions. The bill aims to ensure that any future development of a digital dollar in the U.S. would require explicit authorization from Congress, thereby maintaining control over digital currency policy in the hands of elected representatives.

“A central bank digital currency has the potential for financial monitoring and surveillance and could turn the Federal Reserve into a retail bank. Despite the previous administration’s push for this, Congress should not be circumvented, and our bill ensures it!” – Senator Kevin Cramer, co-sponsor of the Senate’s anti-CBDC bill.

Pathways for Crypto in 401(k) Retirement Plans

In a move aimed at “democratizing access to alternative assets,” an Executive Order was signed on August 7, 2025, directing the Department of Labor and other agencies to explore pathways for including alternative investments, such as cryptocurrency, in 401(k) retirement plans.

The goal is to provide American workers with access to a broader range of investment options that could enhance diversification and potentially offer higher returns. While not a self-executing order, this initiative signals a significant shift in thinking about the composition of retirement portfolios. Experts caution that implementation could take several years and would involve new guidance from regulatory bodies before companies like Fidelity and Vanguard could develop appropriate funds for employers.

Spot ETF Approvals and Market Impact

The SEC’s approval of the first spot Bitcoin Exchange-Traded Funds (ETFs) in January 2024 was a watershed moment for the crypto industry. These investment vehicles have made it significantly easier for both retail and institutional investors to gain exposure to Bitcoin through traditional brokerage accounts, eliminating the technical hurdles of managing digital wallets and private keys. The launch of these ETFs saw a surge in investment inflows, with billions of dollars entering the market, which helped drive Bitcoin’s price to new highs. The success of the Bitcoin ETFs has paved the way for the approval of spot Ether ETFs and has opened the door for potential ETFs based on other digital assets in the future.

“The [SEC’s] approval of spot Bitcoin exchange-traded funds (ETFs) on January 10, 2024, marked a significant milestone in the landscape of crypto investment in the United States. Bitcoin ETFs provide a scalable bridge from traditional finance to crypto — a pivotal integration point.” – Chainalysis

SEC’s “Project Crypto” Aims for Clarity

SEC’s “Project Crypto” Aims for Clarity

On July 31, 2025, SEC Chairman Paul S. Atkins announced “Project Crypto,” a comprehensive initiative designed to modernize the U.S. regulatory framework for digital assets. Acknowledging the confusion that has hindered the industry, the project’s goal is to establish clear guidelines for market participants to determine how different digital assets are classified and regulated. In a significant policy shift, Chair Atkins stated that “most crypto assets are not securities” and should not be governed as such. The project will focus on creating “bright-line rules” and “purpose-fit disclosures, exemptions, and safe harbors” to foster innovation and reshore crypto businesses that had moved overseas due to regulatory uncertainty.

UEEx’s Analysis on the U.S Pro-Crypto Stance

This pro-crypto turn is a geopolitical move. The U.S. framework is now positioned to compete directly with other comprehensive regulatory packages, such as the European Union’s Markets in Crypto-Assets (MiCA) regulation.

The United States’ move toward a clearer and more supportive regulatory stance on cryptocurrencies is likely to have a significant influence on policymakers around the world. Historically, many nations have looked to the U.S. for cues on financial regulation.

As the largest global economy provides a comprehensive framework for digital assets, it may encourage other countries to establish their own clear and innovation-friendly rules to remain competitive in the burgeoning digital economy.Stay informed on the legal challenges shaping the digital asset industry by exploring UEEX’s Crypto Lawsuits page, featuring in-depth analysis of major cases and their implications for the future of cryptocurrency: https://blog.ueex.com/crypto-lawsuits