Blockchain technology was never just about Bitcoin. Over the years, it’s become the backbone of decentralized finance, smart contracts, NFTs, and even digital ID systems. But as its applications expand, so does the strain on its infrastructure, especially around scalability.

Why does a technology designed for innovation still falter under pressure? Why do transactions lag or cost a fortune when networks get busy? The answer lies in how most blockchains were originally built, as they prioritized security and decentralization, often at the expense of speed.

For instance, Bitcoin was never intended to process thousands of transactions per second. And while that has made them secure and reliable, it’s also created serious performance issues as adoption grows.

So, what exactly is this blockchain scalability issue? Read on to learn what it is, why it matters, and what’s being done to fix it.

Key Takeaways

- Blockchain scalability refers to the network’s ability to handle more transactions quickly without losing security or decentralization.

- The blockchain trilemma highlights the challenge of balancing scalability, security, and decentralization simultaneously.

- Key factors causing blockchain scalability issues include network congestion, limited throughput, and cost and capacity constraints.

- Solutions like Layer 2 protocols (e.g., Lightning Network for Bitcoin) help increase transaction speed without sacrificing security.

- Improved consensus mechanisms, such as Ethereum’s move to Proof of Stake, aim to boost scalability while maintaining decentralization.

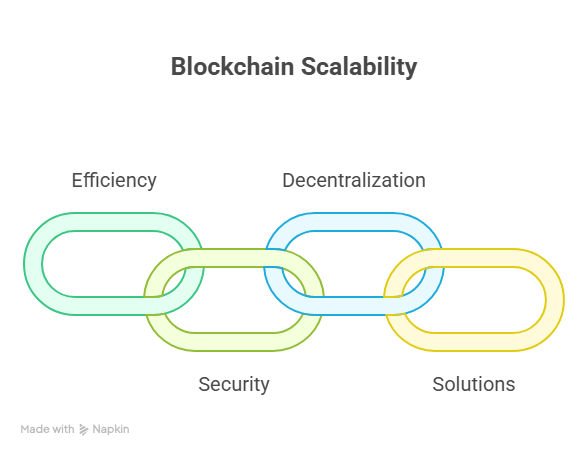

What is Blockchain Scalability?

Blockchain scalability refers to a network’s ability to handle a growing number of transactions, users, and data without slowing down or losing its core features such as security, decentralization, and consensus.

In simpler terms, it’s about how well a blockchain can grow and still function smoothly. For instance, Bitcoin can only process around 7 to 10 transactions per second (TPS). This is quite low when compared to traditional payment systems like Visa which can handle thousands.

As more people use the blockchain, this limited capacity becomes a problem, leading to slower transaction times and higher fees. This challenge arises because blockchain systems often have fixed resources like computing power, storage space, and internet bandwidth.

When demand increases but the system hasn’t been adapted to handle it, performance drops. That’s where scalability comes in. Several core factors shape a blockchain’s scalability: throughput, finality, consensus mechanisms, cost and capacity, each of which will be discussed in detail later on.

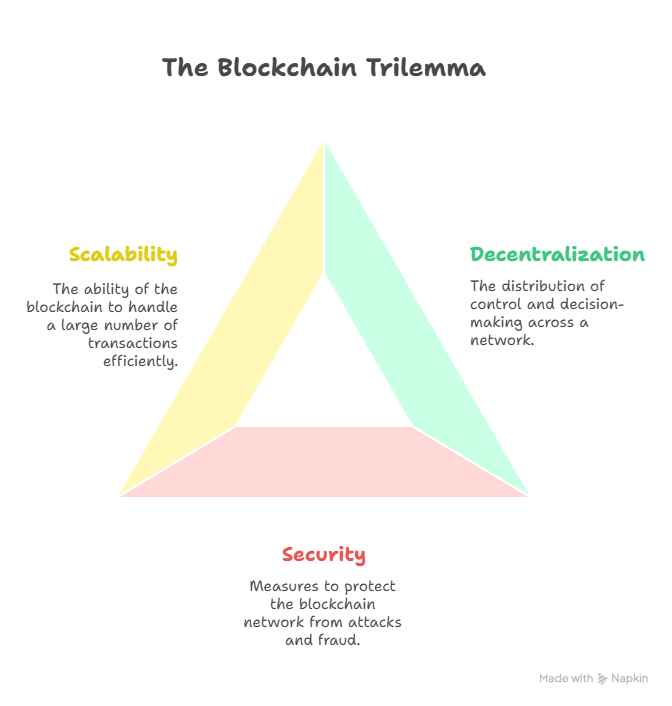

The Blockchain Trilemma: Balancing Decentralization, Security, and Scalability

A major challenge in blockchain technology is the blockchain trilemma, which is the idea that a blockchain network can only fully optimize two out of three critical features: decentralization, security, and scalability.

Decentralization means distributing control across many independent participants, which prevents any single authority from dominating the network. This is what makes blockchains trustless and resistant to censorship.

Security ensures the network can defend itself from attacks and fraud, often requiring substantial computational effort. Lastly, scalability refers to the network’s ability to handle a growing number of transactions quickly and efficiently.

The problem is that improving one or two of these features usually weakens the third. Take Bitcoin, for example: it prioritizes decentralization and security, making it highly reliable and resistant to attacks.

However, this limits its transaction speed to about 7 transactions per second compared to Visa. This low scalability makes Bitcoin less practical for everyday use.

On the flip side, some blockchains increase scalability by limiting decentralization, for instance, by reducing the number of validators to speed up transactions. While this improves performance, it compromises the network’s decentralized nature and may introduce security risks.

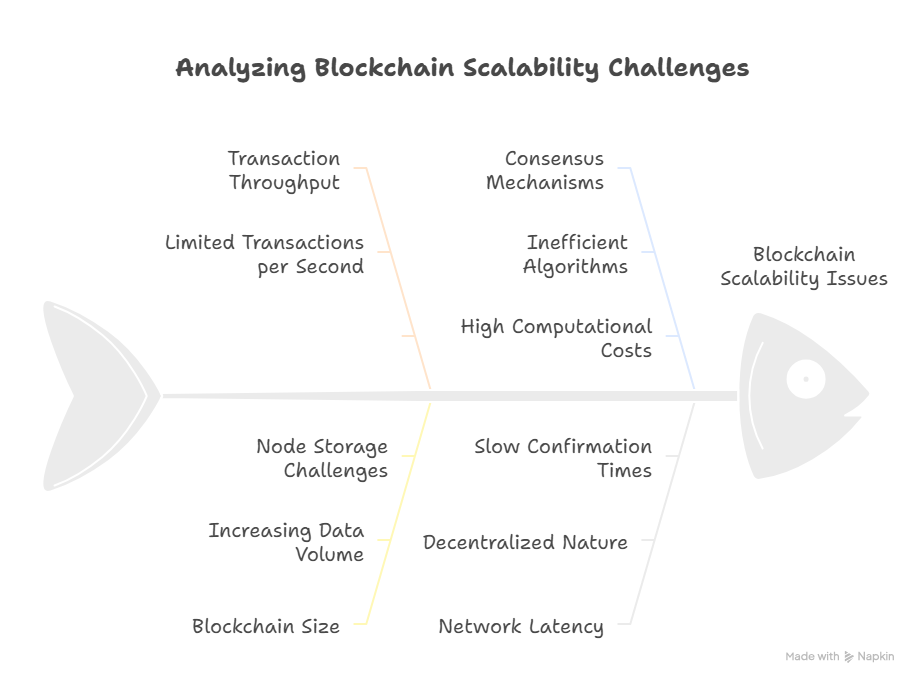

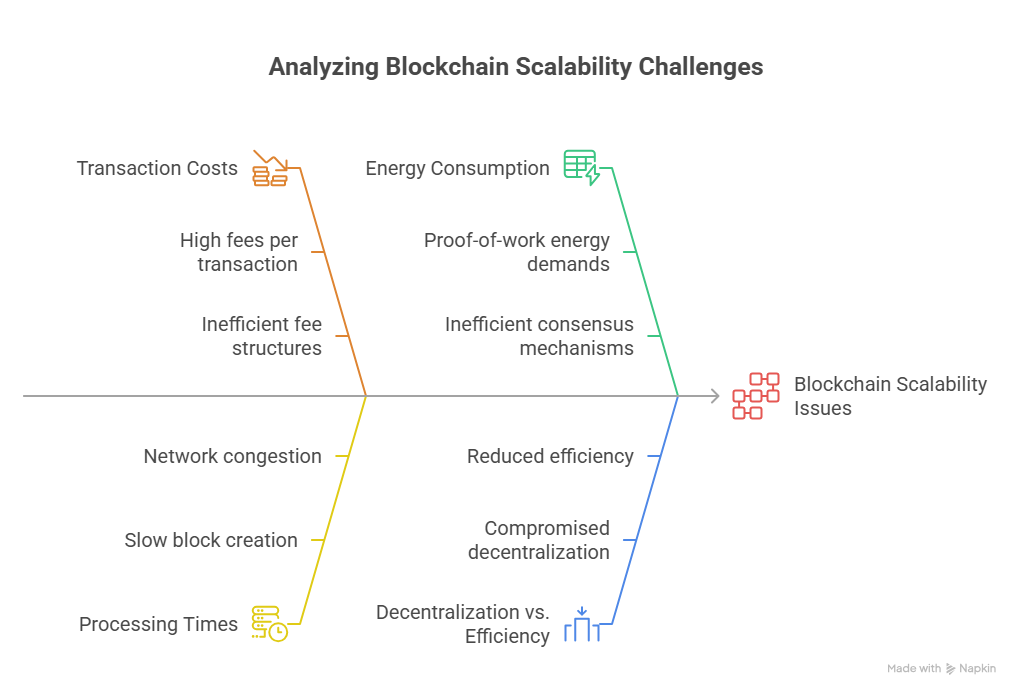

Factors Causing Blockchain Scalability Issues

When discussing blockchain scalability, it’s important to understand the main factors that limit the performance and widespread adoption of blockchain networks. Below are some of the key factors affecting blockchain scalability:

Throughput (Transactions Per Second)

Throughput refers to how many transactions a blockchain can process every second. This directly affects how fast the network can handle users’ activity.

As mentioned above, Bitcoin processes about 7 transactions per second (TPS), and Ethereum processes around 15–30 TPS in its current form. The low throughput of traditional blockchains becomes a major issue during periods of high demand.

For example, during the 2017 crypto boom, Ethereum became congested due to the popularity of CryptoKitties (a blockchain-based game), causing transaction fees to spike and confirmation times to lag.

As more users join a blockchain, the demand for processing power rises but the system may not be able to keep up unless changes are made to how transactions are handled or blocks are built.

When more users send transactions than the network can process, it causes delays and increases transaction fees.

Cost and Capacity

One of the biggest challenges in blockchain scalability is how much data the network needs to store and how much it costs to do so.

Every transaction ever made on a blockchain is stored permanently, starting from the genesis block (the first block) to the most recent one. As time goes on, the blockchain grows in size.

Each full node (computers that store a complete copy of the blockchain) needs to download and maintain this growing data. Over time, this becomes more demanding in terms of storage space, processing power, and electricity.

As of now, the Bitcoin blockchain is over 500GB in size. Not every participant can afford the hardware or bandwidth to maintain a full node, which limits who can contribute to the network’s decentralization.

This creates a scalability issue because if fewer people can afford to run nodes, the network may become more centralized, which goes against one of blockchain’s core goals.

Network Size and Node Participation

Network size and node participation also create blockchain scalability issues. As the number of nodes increases, the network becomes more decentralized and secure. However, more nodes mean that every transaction and block must be shared and verified by many participants, increasing communication overhead.

When a transaction is broadcast, it must reach all nodes, and when a new block is added, it also has to propagate throughout the entire network. This process consumes bandwidth and increases propagation delay, especially with larger blocks or slower internet connections.

If propagation is too slow, it can cause blockchain forks, reduce consensus efficiency, and expose the network to attacks. For example, Bitcoin blocks are limited in size (around 1 MB) to help reduce propagation delay. However, this also limits the number of transactions that can be processed per block, making it less scalable.

Latency and Finality

Latency is the time it takes for a transaction to be processed, while finality refers to when a transaction becomes irreversible and is considered confirmed. In many blockchains, finality isn’t instant.

For instance, in Bitcoin, it takes 6 confirmations (or blocks) to consider a transaction secure. Since a new block is mined every 10 minutes, this means a user may need to wait around an hour for a transaction to fully settle.

This delay is a problem for real-world applications like online payments or gaming platforms, where users expect near-instant results. In contrast, centralized systems like credit card networks offer finality in seconds.

Consensus Mechanisms (Proof of Work vs. Proof of Stake)

Consensus mechanisms are the methods blockchains use to agree on which transactions are valid. For example, Proof of Work (PoW), used by Bitcoin, requires miners to solve complex puzzles.

This process is slow and uses a lot of energy, limiting transaction speed. On the other hand, Proof of Stake (PoS), used by newer blockchains like Ethereum 2.0, is faster and more energy-efficient.

Therefore, it allows higher transaction throughput and faster confirmations. Some blockchains, such as Solana, use combinations of consensus methods to increase speed dramatically (up to 65,000 TPS). However, these trade-offs sometimes reduce decentralization or security.

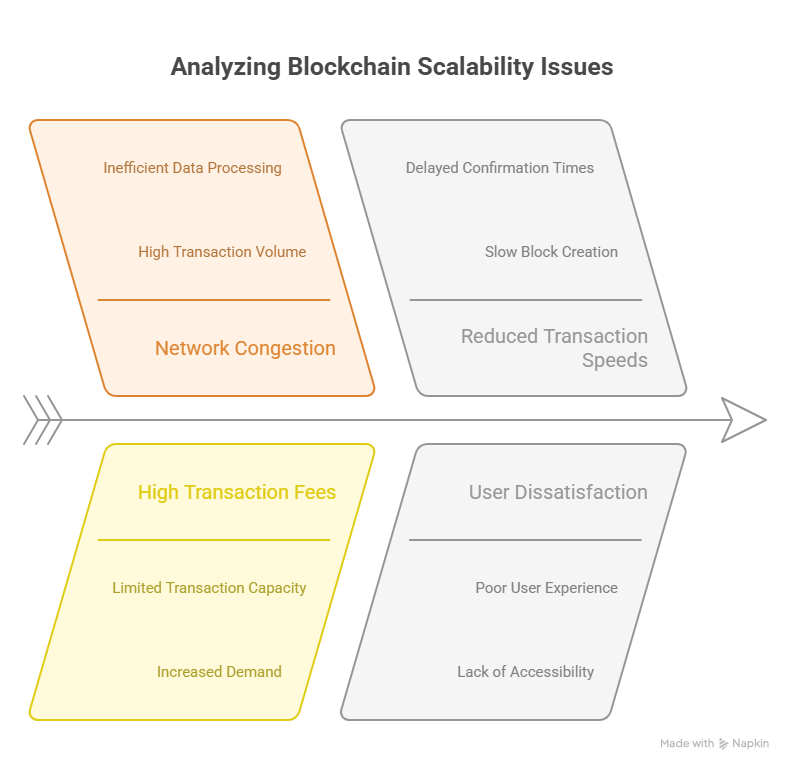

Impact of Blockchain Scalability Issues on Users and Applications

Source: Freepik

Scalability problems directly affect the user experience and the practical use of blockchain applications. Some of the impacts it has on users and applications include:

Slow Transaction Processing and Confirmation Times

One of the most noticeable effects of blockchain scalability issues is slow transaction processing. When many users try to make transactions simultaneously, the network becomes congested, causing delays.

For instance, Bitcoin transactions usually take about 10 minutes to confirm under normal conditions. However, during peak times, such as the cryptocurrency bull run in late 2017 or the surge in early 2021, confirmation times stretched to hours.

Additionally, at its peak, Ethereum’s network congestion caused transactions to slow dramatically. Consequently, this congestion frustrated users who relied on timely interactions with smart contracts and decentralized apps.

Increased Transaction Fees During Peak Usage

As transaction times slow, fees tend to rise because users compete to have their transactions processed faster by offering higher fees to miners.

During the late 2017 Bitcoin boom, average transaction fees spiked to over $37 per transaction, making it impractical for small payments. These high fees discourage everyday users from using blockchain networks for small or routine transactions.

For example, using Bitcoin to buy a cup of coffee may become more expensive during fee spikes, limiting the practicality of blockchain for microtransactions or retail payments.

Limitations on Real-World Applications Like Payments and Supply Chain

Scalability issues also limit blockchain’s ability to support complex, real-world applications.

This limitation extends to supply chain management, where tracking thousands of products with frequent updates requires a fast and scalable network.

Projects like IBM’s Food Trust use blockchain for supply chain transparency, but scalability constraints sometimes slow down real-time data updates or increase costs.

Network Instability and Outages

When a blockchain network becomes overloaded, it may suffer from instability or even temporary outages.

For instance, Solana, known for its high throughput experienced multiple network outages in 2021 and 2022 due to overwhelming transaction loads. These outages can disrupt services built on the blockchain and damage users’ trust.

Approaches and Solutions to Address Blockchain Scalability Issues

Source: Freepik

The urgent need for scalable blockchain networks has led to the development of various solutions designed to address key scalability challenges, such as limited transaction throughput.

These solutions aim to increase network capacity and transaction speed while maintaining the security and decentralization that are central to blockchain’s value. These include:

Layer 1 (On-Chain) Solutions

Layer 1 solutions focus on optimizing the blockchain’s core protocol. These upgrades enhance the network’s capacity by changing how the blockchain itself operates. Common Layer 1 approaches include:

- Segregated Witness (SegWit)

Introduced by Bitcoin developers, SegWit improves scalability by changing how transaction data is stored. By separating transaction signatures from the rest of the data, SegWit frees up space within each block, allowing more transactions to fit into Bitcoin’s 1MB block size.

This boosts transaction throughput and reduces fees, although it’s not a complete fix for scalability.

- Sharding

Popularized by Ethereum, sharding breaks the blockchain into smaller, parallel “shards,” each handling its own subset of transactions.

This allows the network to process many transactions simultaneously, significantly increasing throughput. However, sharding requires complex communication between shards and can pose security challenges.

- Hard Forks

These involve fundamental changes to a blockchain’s rules, such as increasing block size or reducing block creation time. Hard forks can boost throughput but often lead to community splits, as seen with Bitcoin Cash.

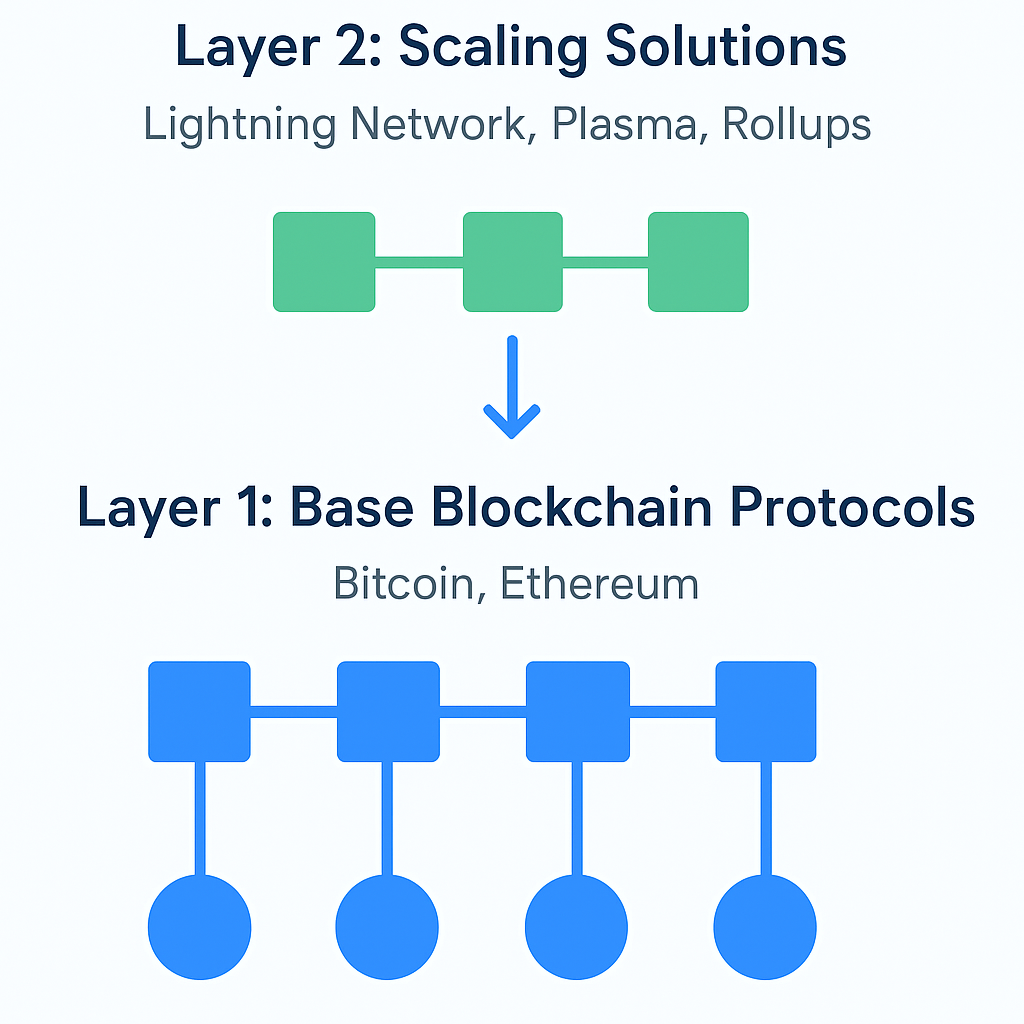

Layer 2 (Off-Chain) Solutions

Layer 2 solutions build additional protocols on top of the base blockchain to “offload” transaction processing. This reduces congestion on the main chain and speeds up transaction times without altering the underlying blockchain protocol. Key Layer 2 methods include:

- Sidechains

Separate blockchains connected to the main chain, sidechains allow transactions to occur off the main network and settle back later. For example, Ethereum’s Plasma and Polkadot’s Parachains use sidechains to increase scalability while maintaining security.

- State Channels

These allow participants to conduct multiple transactions off-chain and only record the final result on the main blockchain. This method is perfect for high-frequency, low-value transactions such as gaming or micropayments.

- Payment Channels & Lightning Network

The Lightning Network (Bitcoin) and Raiden Network (Ethereum) create direct, off-chain payment channels between users. These enable instant, low-cost transactions by settling final balances on the main blockchain later.

- Nested Blockchains

These involve a main blockchain overseeing multiple secondary chains, enabling parallel transaction processing without sacrificing security.

Scalable Consensus Mechanisms

Consensus algorithms are essential to blockchain security, but can also limit scalability. New consensus methods aim to speed up transaction validation with less energy and time:

- Proof of Stake (PoS)

PoS enables faster transaction processing and reduces energy consumption. Ethereum’s switch from Proof of Work to PoS dramatically improved scalability by replacing energy-intensive mining with validators chosen based on their stake.

Additionally, Algorand has adopted a Pure Proof of Stake (PPoS) consensus mechanism. This approach is unlike traditional PoS systems that often rely on a fixed set of validators.

In this instance, Algorand randomly selects a small committee of validators for each new block. This approach helps maintain both decentralization and security. It also allows the network to achieve high scalability and fast finality, making it suitable for real-time applications.

- Delegated Proof of Stake (DPoS)

In this case, token holders elect a small group of trusted validators to create blocks, boosting throughput at the cost of some decentralization. For instance, one of the most well-known DPoS blockchains, EOS uses 21 elected block producers to validate transactions quickly and at low cost.

- Proof of Authority (PoA)

This refers to a reputation-based system where only selected nodes validate transactions. Furthermore, PoA offers high efficiency for private or consortium blockchains.

Byzantine Fault Tolerance (BFT)

Designed to maintain consensus even if some nodes act maliciously, BFT variants improve reliability and throughput in permissioned blockchain networks.

Hybrid Solutions

Some blockchain projects combine multiple approaches to maximize scalability. For example, the Core DAO Network merges Bitcoin’s Proof of Work security with Ethereum’s Delegated Proof of Stake efficiency through its unique Satoshi Plus consensus.

This hybrid method allows higher transaction volumes while preserving decentralization and security, paving the way for scalable decentralized applications (dApps).

Cross-Chain Solutions

With many blockchains operating independently, interoperability becomes a key factor in addressing scalability. Cross-chain protocols like Polkadot and Cosmos enable different blockchains to communicate and transfer assets seamlessly.

By linking networks, these solutions increase the overall capacity and flexibility of the blockchain ecosystem, helping to ease scalability constraints.

Trade-Offs and Challenges in Solving Blockchain Scalability Issues

When it comes to solving blockchain scalability issues, there are a lot of challenges and trade-offs involved.

Below are some key trade-offs and challenges involved:

Balancing Decentralization and Scalability

One of the biggest challenges in solving blockchain scalability issues is the trade-off between decentralization and scalability. Improving scalability often means reducing decentralization, which goes against the core principle of blockchain.

Finding the right balance where the network remains secure, decentralized, and scalable is difficult and requires careful design choices.

Consensus and Community Agreement

In decentralized systems, no single authority can enforce changes. To implement upgrades, consensus must be reached among all stakeholders, miners, developers, and users.

Without broad agreement, changes can cause splits in the community, resulting in separate blockchains, as seen with Bitcoin Cash and Ethereum Classic. These splits can weaken the overall ecosystem.

Backward Compatibility and Upgrades

Any upgrade to a blockchain must be backward-compatible, since there are no forced updates in decentralized networks. This means new versions must work with older ones to avoid breaking the system.

However, this constraint makes implementing scalability solutions more difficult and increases the need for thorough testing.

Cost of Community Splits

When disagreements lead to forks or splits, the entire blockchain community bears the cost. Maintaining a blockchain requires ongoing effort from developers, miners, and users. Splits dilute resources and passion, potentially harming the ecosystem’s growth and trust.

The Future of Blockchain Scalability

Looking ahead, blockchain scalability is set to improve significantly as new technologies and approaches continue to develop. The challenge of balancing security, decentralization, and speed remains.

However, ongoing innovations are bringing us closer to a blockchain network that can handle large-scale use without compromising its core principles. One key area of progress is improving the blockchain’s underlying protocols, often called Layer 1 solutions.

These involve redesigning how the blockchain works at its core such as changing the way transactions are validated or how data is stored to increase the number of transactions processed per second.

At the same time, connecting different blockchains through cross-chain technology is becoming more important. Instead of isolated blockchains working alone, these solutions allow different networks to exchange information and assets easily.

Finally, interoperability, which is the ability of different blockchain systems to communicate and work together, is also gaining momentum. In short, the future of blockchain scalability looks promising, with advancements targeting both the core technology and how blockchains interact with one another.

Conclusion

Solving the blockchain scalability issue is a process that needs the effort of developers, users, and businesses working together. Scalability is not just about faster transactions; it means building networks that can grow and adapt while keeping security and decentralization intact.

As more industries and people use blockchain, the need for practical and lasting scalability solutions becomes more important. Whether it’s through Layer 2 solutions or better consensus methods addressing these challenges is key for blockchain’s future.

The work happening now sets the stage for blockchains that can handle real-world needs without losing what makes them different. As these improvements develop, blockchain will become more useful in daily life and in several industries beyond just technology.

Frequently Asked Questions(FAQs)

What is Blockchain Scalability?

Blockchain scalability refers to a network’s ability to process a growing number of transactions efficiently without compromising its security or decentralization. It determines how well a blockchain can handle increased demand as more users and applications join the network.

Is Scalability The Only Challenge Blockchains Face?

No, scalability is one of several challenges, alongside maintaining security and decentralization. These three factors form what is known as the “blockchain trilemma,” where improving one often impacts the others.

What Are Some Common Blockchain Scalability Issues?

Common issues include network congestion, limited transaction throughput, high transaction fees, latency in block confirmation and cost and capacity constraints.

Are Layer 2 Solutions Effective For Improving Blockchain Scalability?

Yes, Layer 2 solutions like the Lightning Network (for Bitcoin) and Plasma (for Ethereum) help by handling transactions off the main chain, reducing congestion and increasing speed.

What Are Layer 1 Improvements In Blockchain Scalability?

Layer 1 improvements involve changes to the base blockchain protocol itself, such as introducing new consensus mechanisms (e.g., Proof of Stake), sharding, or optimizing data structures to increase throughput and reduce latency.